The recent escalation between Israel and Iran in June 2025 has sent ripples across global financial markets. With missile strikes, rising oil prices, and heightened geopolitical tension, investors are reacting with caution, triggering significant volatility in global stock indices. Here’s a breakdown of how the conflict is influencing financial markets worldwide.

📉 Impact on U.S. Stock Markets

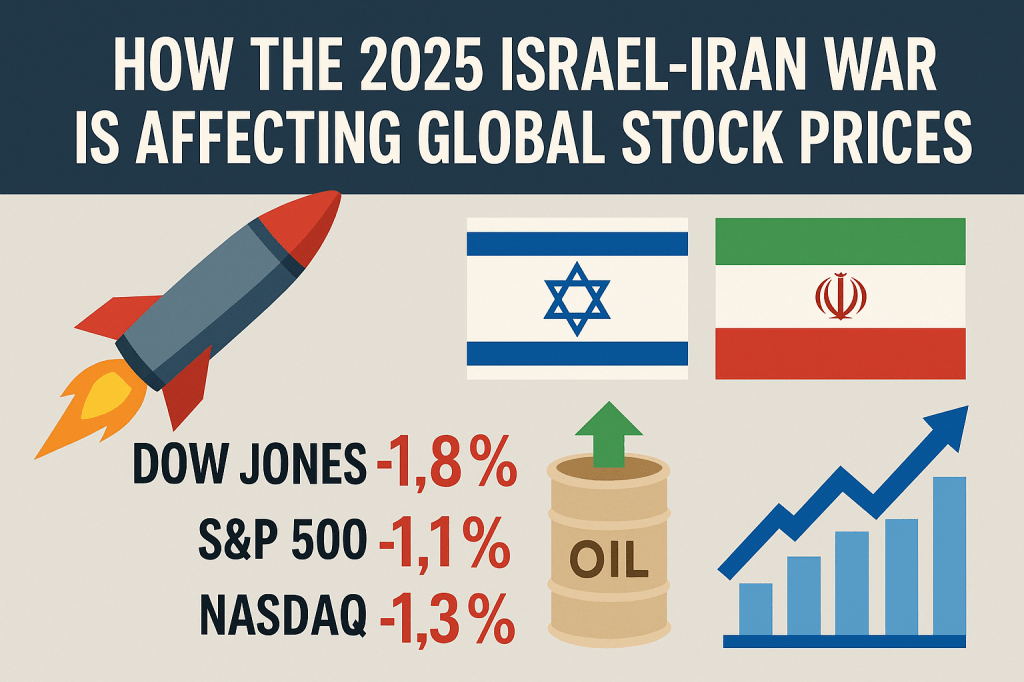

Following Israel’s June 13 strikes on Iranian infrastructure, major U.S. indices experienced notable declines:

- Dow Jones Industrial Average: Dropped ~1.8%

- S&P 500: Fell ~1.1%

- Nasdaq Composite: Down ~1.3%

Investors shifted from equities to safer assets such as Treasury bonds, gold, and the U.S. dollar, reflecting a risk-off sentiment. However, optimism returned quickly as diplomatic efforts signaled a pause in escalation. The S&P 500 bounced back with a ~1% gain in the following trading sessions.

🛢️ Oil and Energy Sector Reactions

Oil prices surged sharply:

- Brent crude rose by approximately 11%, reaching multi-month highs.

Surprisingly, oil stocks did not benefit as expected. Leading energy ETFs like XLE and companies such as Halliburton saw declines, with the latter falling nearly 10%. This suggests that the market views the oil price surge as temporary, not sustainable.

At the same time, safe-haven assets like gold and the U.S. dollar appreciated, further signaling investor caution.

🇮🇱 Israel’s Stock Market Defies Global Trend

Contrary to global equities, Israel’s stock market strengthened:

- Tel Aviv 125 Index (TA-125) rose by 2.6%.

- The Israeli shekel appreciated by 4.6%.

Investors are betting on Israel’s strategic and military advantage, and its perceived ability to end the conflict quickly. Bond spreads narrowed, and local confidence surged.

🌏 Regional and International Market Responses

- Asia: Markets in Japan, China, and South Korea dipped initially but recovered as the conflict appeared contained regionally.

- Australia: Equity markets fell slightly. Rising oil prices led to an 8% increase in domestic fuel costs, impacting consumer sentiment and business outlook.

- Europe: Volatility increased in European indices, especially in energy-intensive sectors.

📈 Key Market Drivers

- Oil Price Spike: Triggered inflation fears and raised concerns about monetary policy tightening.

- Flight to Safety: Investors moved into gold, bonds, and USD.

- Israeli Resilience: Local markets reacted positively due to investor confidence in national stability.

- Risk of Broader Escalation: RBC warned of a potential 20% drop in the S&P 500 if conflict drags on, especially if oil prices remain high.

🧠 Investor Strategy Insights

- Track Oil Volatility: Sustained high prices may affect inflation and central bank decisions.

- Watch for Diplomatic Signals: A ceasefire or peace talks can restore market confidence.

- Diversify with Safe-Haven Assets: Consider allocating to gold or defensive sectors.

- Monitor Israeli Assets: Current bullish sentiment may present short-term opportunities.

- Beware Valuation Risk: U.S. stocks are still at elevated multiples; geopolitical risks may catalyze correction.

The 2025 Israel-Iran conflict has led to a wave of short-term volatility in global markets. While oil and safe-haven assets surged, equity indices showed mixed performance. The biggest lesson for investors: geopolitical events, even regional, can quickly reshape global market sentiment. Staying alert, diversified, and responsive to policy shifts is critical in such turbulent times.

Leave a comment