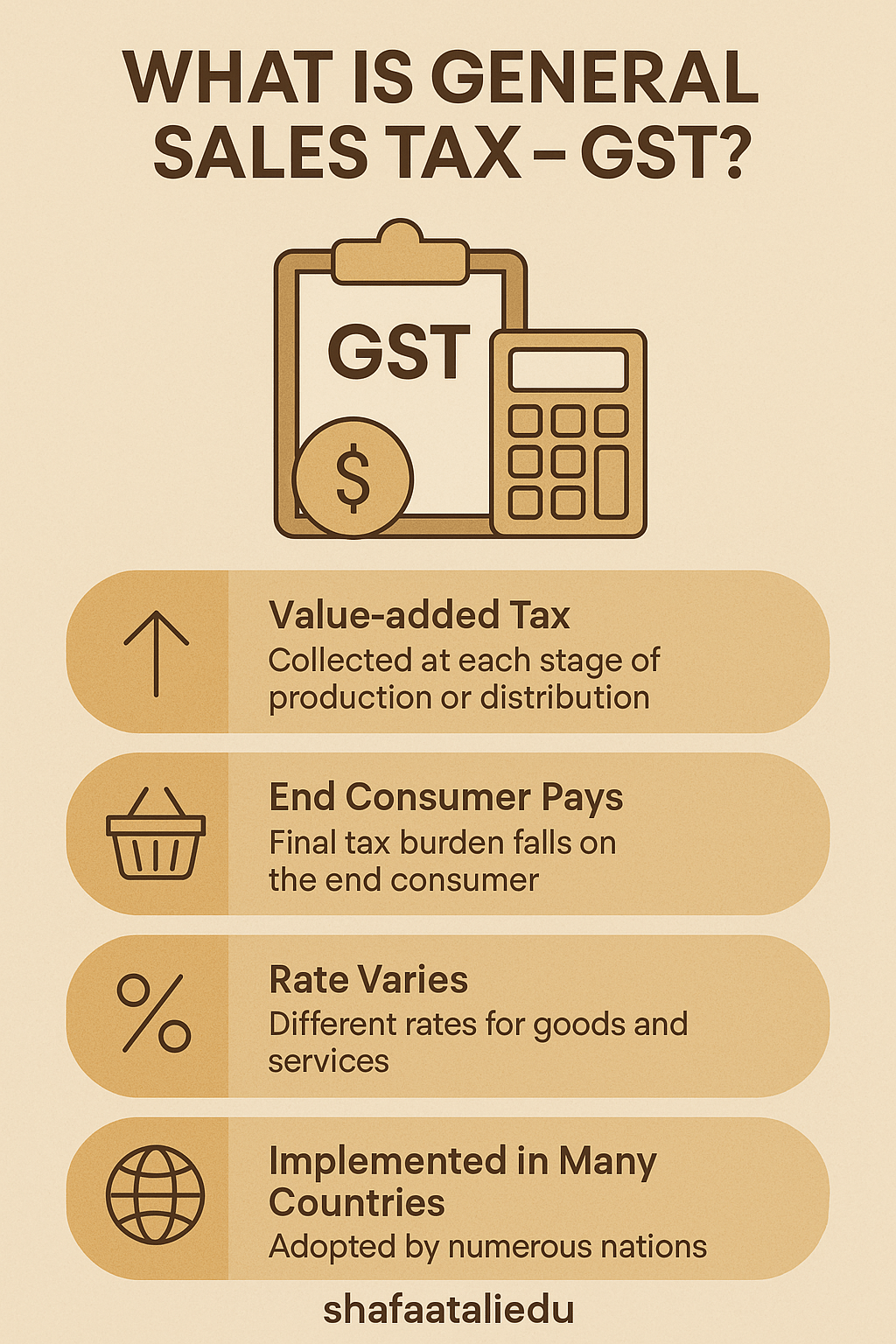

GST stands for Goods and Services Tax, a value-added tax charged on most goods and services sold for domestic use. It’s a way for governments to collect revenue, and it’s commonly used in many countries like India, Canada, Australia, and Singapore. Think of GST as a modern version of sales tax—simpler, broader, and more consistent.

Here’s how it works: when you buy something, GST is added to the price. The seller collects that tax and sends it to the government. For example, if you buy a phone for $500 and the GST rate is 10%, you’ll pay $50 in tax, making the total $550.

But here’s what makes GST different: businesses also pay GST on the supplies or services they buy. They can then claim a credit for that tax, meaning only the final buyer (the consumer) bears the full cost. This “tax on value added” system avoids double taxation and keeps prices fair.

GST often replaces older taxes like service tax, excise duty, and VAT. In countries like India, GST has streamlined a very complex tax structure into one unified system with different slabs—usually 5%, 12%, 18%, and 28%—depending on the product or service.

If you’re a business owner, you may need to register for GST, charge it on your invoices, and file regular returns. It’s essential to keep accurate records and understand the rules in your country.

GST has made taxation more transparent and efficient in many economies. As global trade grows, knowing how GST works helps you make better financial and business decisions.

Leave a comment