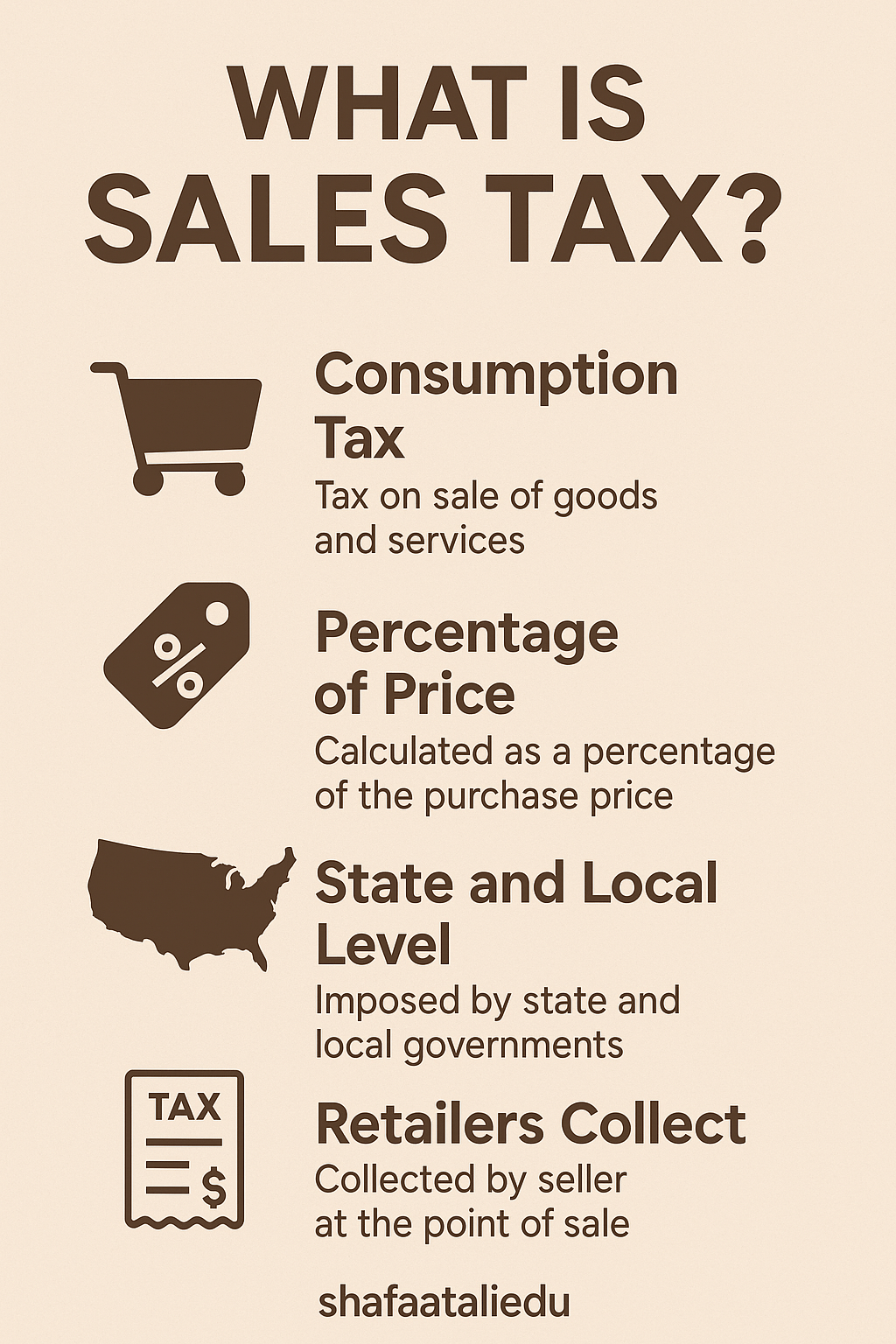

Sales tax is a small percentage of money added to the price of goods or services at the time you buy them. It’s a way for local and state governments to raise money to pay for things like schools, roads, and public safety. If you’ve ever bought a T-shirt and noticed the total price was a bit higher than the tag said—that extra bit was sales tax.

Let’s say you buy a book for $10, and your state’s sales tax is 7%. At checkout, you’d pay $10 + $0.70 in tax, for a total of $10.70.

The business collects this tax from you and later sends it to the government. So while it’s the customer who pays the tax, it’s the business’s job to handle it correctly. This means that if you’re starting a business, you’ll need to register for a sales tax permit and learn how to charge, collect, and file sales tax.

Sales tax rules vary depending on where you live. Some states in the U.S. don’t have sales tax at all (like Oregon), while others have different rates depending on the city or county. Also, not everything is taxed—essential items like groceries or medicine are often exempt.

Online shopping also involves sales tax, especially since many states now require online sellers to collect it too.

Understanding sales tax is important whether you’re a shopper or a business owner. It might seem small, but it plays a big role in funding community services and keeping businesses legally compliant.

As e-commerce and digital services grow, sales tax laws continue to evolve—so staying informed is more important than ever.

Leave a comment