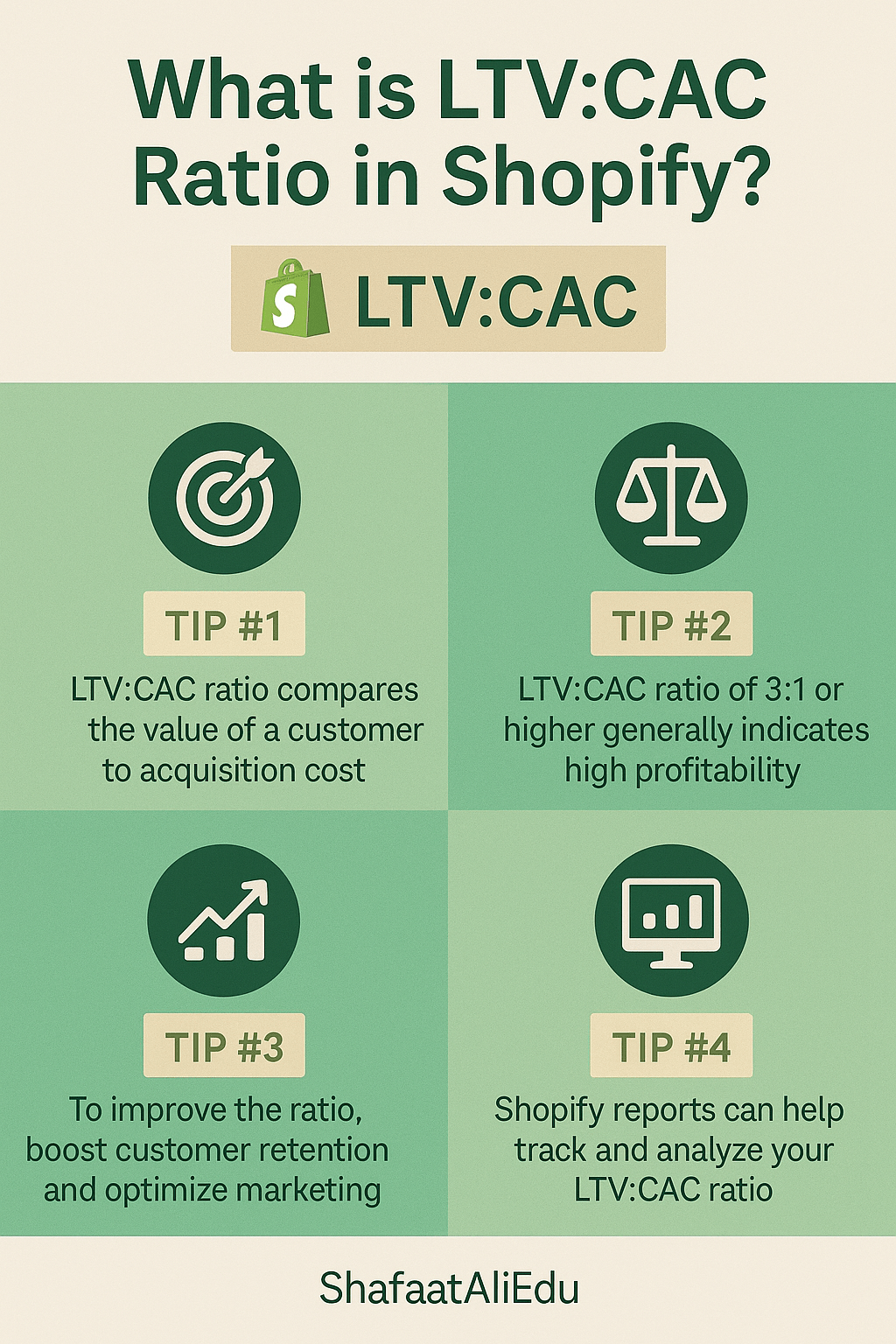

The LTV:CAC ratio stands for Customer Lifetime Value to Customer Acquisition Cost, and it’s a powerful metric for Shopify store owners. It tells you how much profit you’re making from each customer compared to how much you spent to get them.

Here’s a simple way to think about it:

Imagine you own a Shopify store selling candles. If you spend $20 on Facebook ads to get one new customer, and that customer ends up spending $100 over time, your LTV is $100 and your CAC is $20. Your LTV:CAC ratio is 5:1, which means you’re earning five times what you spent to get that customer—a great return!

Why does this matter?

- A high LTV:CAC (like 3:1 or higher) means you’re making a healthy profit and your marketing is working well.

- A low ratio (like 1:1 or lower) means you’re spending as much—or more—than you’re earning from customers, which can quickly sink your business.

How to calculate it:

LTV:CAC Ratio = Customer Lifetime Value / Customer Acquisition Cost

For Shopify users:

- LTV can be tracked using analytics apps like Shopify’s built-in reports or tools like Lifetimely. It looks at average order value and how often people buy.

- CAC includes costs like ads, influencer payments, and email marketing—anything spent to gain customers.

Example:

- LTV: $150

- CAC: $50

LTV:CAC = 150 ÷ 50 = 3:1

The higher your ratio, the more room you have to invest in growth. Mastering this ratio helps you build a sustainable, profitable Shopify store that can scale smartly.

Leave a comment