Every day, you make choices—some big, some small. You decide how to spend your money, your time, and your energy. What many people don’t realize is that every choice comes with a hidden cost, even when no money changes hands. That hidden cost is called opportunity cost.

Understanding opportunity cost can completely change how you think about decisions, whether you’re managing personal finances, running a business, or planning your career. Let’s break it down in a simple, practical way.

Opportunity Cost Explained in Plain Language

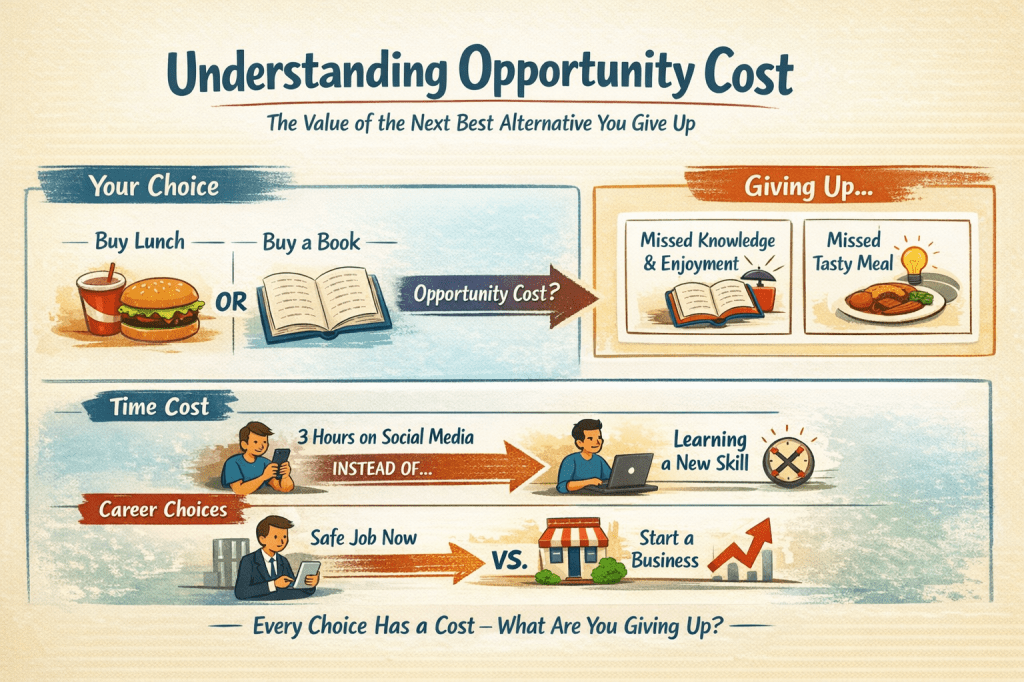

Opportunity cost is the value of the next best alternative you give up when you make a decision.

In other words:

When you choose one option, you automatically give up another. The benefit of the option you didn’t choose is your opportunity cost.

It’s not always about money. Often, it’s about time, experiences, or future benefits.

A Simple Everyday Example

Imagine you have $10.

You can either:

- Buy lunch at a café

or - Buy a book you’ve wanted to read

If you choose the lunch, the opportunity cost is the knowledge and enjoyment you would have gained from the book.

If you choose the book, the opportunity cost is the meal you didn’t eat.

The key idea:

You can’t have both, so choosing one means sacrificing the other.

Opportunity Cost Is Not Just About Money

Many beginners think opportunity cost only applies to finances. In reality, it shows up in almost every decision you make.

Opportunity Cost of Time

Time is one of your most limited resources.

Example:

- Spending 3 hours scrolling social media

vs. - Spending 3 hours learning a new skill

The opportunity cost of scrolling is the skill, income, or progress you could have gained during that time.

This is why opportunity cost is such a powerful concept—it helps you see the real price of how you spend your time.

Opportunity Cost in Career Choices

Let’s say you accept a comfortable job that pays well but offers little growth.

The opportunity cost might be:

- Starting a business

- Learning high-demand skills

- Taking a role with better long-term growth

Even good choices have opportunity costs. The goal isn’t to avoid them—it’s to understand them.

Opportunity Cost in Business and Economics

In economics and business, opportunity cost plays a huge role in decision-making.

Business Example

A company has a budget to either:

- Invest in marketing

or - Improve its product

If it chooses marketing, the opportunity cost is the better product it could have built.

If it chooses product development, the opportunity cost is the potential customers it didn’t reach.

Smart businesses constantly evaluate opportunity costs to decide where their resources will have the biggest impact.

Why Economists Care So Much About It

Economists use opportunity cost to explain:

- Why resources are limited

- Why trade-offs exist

- Why “free” things are rarely truly free

Even when something costs $0, it still costs time, attention, or lost alternatives.

How to Identify Opportunity Cost in Your Own Life

You don’t need to be an economist to use this idea. Here’s a simple way to apply it:

- List your options

What are the realistic alternatives? - Identify the next best choice

Not every alternative matters—only the best one you’re giving up. - Compare long-term value, not just short-term comfort

The most tempting option isn’t always the most valuable. - Ask: “What am I sacrificing by choosing this?”

This single question can lead to better decisions.

Common Misunderstandings About Opportunity Cost

Let’s clear up a few misconceptions:

- It’s not always about money

Time, energy, health, and relationships all have opportunity costs. - A higher price doesn’t always mean higher opportunity cost

Sometimes the cheaper option costs you more in the long run. - There is no “right” choice—only informed choices

Opportunity cost helps you decide consciously, not emotionally.

Why Opportunity Cost Matters More Than You Think

Once you understand opportunity cost, you start seeing life differently.

You become more intentional about:

- How you spend your time

- Where you invest your money

- Which goals you prioritize

Instead of asking, “Can I afford this?”

You start asking, “What am I giving up to afford this?”

That shift alone can improve your financial decisions, productivity, and long-term success.

What This Means for You

Opportunity cost isn’t meant to make decisions harder—it’s meant to make them clearer.

When you understand the trade-offs behind every choice:

- You waste less time

- You regret fewer decisions

- You align your actions with what truly matters to you

If you’re interested in improving how you make decisions around money, business, communication, and personal growth, you may also find value in my books on personal development and business. They’re written with the same beginner-friendly, practical approach.

Leave a comment