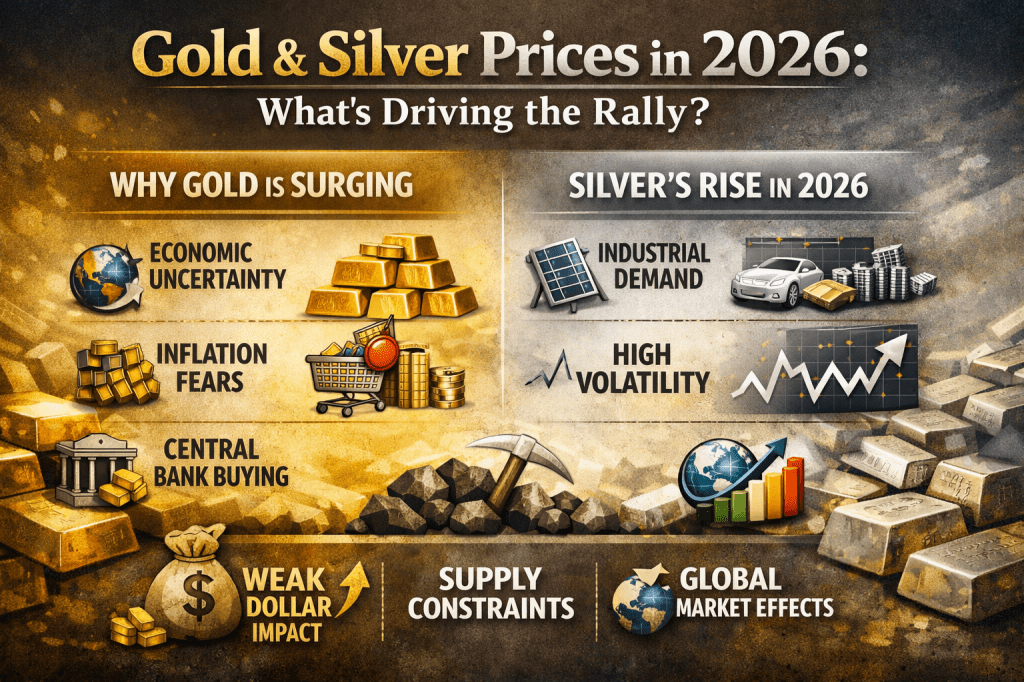

In 2026, gold and silver have moved back into the global spotlight. Prices of both precious metals have climbed sharply, drawing attention from investors, policymakers, and everyday consumers alike. From economic uncertainty to strong industrial demand, several forces are shaping how gold and silver are behaving this year.

This article explains what is happening with gold and silver prices in 2026, why these metals matter, and what the trend could mean going forward — all in simple, beginner-friendly language.

A Strong Year for Precious Metals

Gold and silver are known as precious metals, meaning they are rare, valuable, and widely used as stores of wealth. In 2026, both metals have posted notable gains compared to previous years.

- Gold continues to attract investors looking for stability during uncertain economic conditions.

- Silver has gained attention not only as an investment but also because of its heavy use in industries like solar energy, electronics, and electric vehicles.

These dual roles — financial protection and industrial utility — are key to understanding why prices have remained strong.

Why Investors Turn to Gold in 2026

Gold is often called a safe-haven asset. This means investors buy it when they are worried about inflation, currency weakness, or stock market volatility.

Several factors are boosting gold demand this year:

1. Economic Uncertainty

Global economies are still adjusting to high debt levels, changing interest-rate policies, and slower growth in some regions. When confidence in the economy weakens, gold often benefits.

2. Inflation Concerns

Inflation refers to the rising cost of goods and services over time. Even moderate inflation can reduce the purchasing power of money, making gold attractive as a long-term store of value.

3. Central Bank Buying

Many central banks — including those in emerging economies — continue to increase their gold reserves. This reduces reliance on foreign currencies and supports long-term demand.

Central bank: A country’s main financial authority, responsible for managing money supply and interest rates.

Silver’s Unique Position in 2026

While gold is mainly held for investment and jewelry, silver plays a much larger role in the modern economy.

Industrial Demand Is Rising

Silver is a key component in:

- Solar panels

- Electric vehicles

- Smartphones and electronics

- Medical equipment

As governments and companies push for cleaner energy and advanced technology, industrial demand for silver has increased significantly.

Industrial demand: When a material is used in manufacturing and technology rather than being held as an investment.

Higher Volatility Than Gold

Silver prices tend to move faster — both up and down — than gold prices. This is known as volatility, which means sharp price changes over short periods. In 2026, this volatility has attracted traders looking for higher returns, adding more momentum to price movements.

The Role of the U.S. Dollar

Gold and silver are usually priced in U.S. dollars. When the dollar weakens, precious metals often become cheaper for buyers using other currencies, increasing demand.

Shifts in monetary policy by institutions like the Federal Reserve continue to influence currency markets in 2026, indirectly affecting gold and silver prices worldwide.

Supply Constraints Add Pressure

Another important factor is limited supply.

- Gold mining production grows slowly because new mines take years to develop.

- Silver supply faces additional pressure because much of it is produced as a by-product of mining other metals.

When demand rises faster than supply, prices naturally move higher — a trend visible in both metals this year.

Impact on Local and Global Markets

Rising global prices affect local markets everywhere.

- Jewelry becomes more expensive for consumers.

- Investors see higher entry costs but also stronger long-term value potential.

- Emerging markets, including parts of Asia and the Middle East, experience noticeable increases in domestic gold and silver rates due to global price movements.

Bullion: Gold or silver in bulk form, usually bars or ingots, traded for investment purposes.

Are Prices Sustainable?

Market analysts remain divided.

- Optimistic views suggest that continued economic uncertainty, central bank buying, and industrial demand could keep prices elevated.

- Cautious views warn that sharp rallies can lead to short-term corrections, where prices pull back before stabilizing.

This means investors in 2026 are balancing opportunity with risk.

What This Means for You

For everyday readers, gold and silver prices in 2026 highlight a few key lessons:

- Precious metals still play an important role during uncertain economic times

- Gold offers stability, while silver offers growth potential with higher risk

- Long-term trends matter more than short-term price swings

Whether you are an investor, a jewelry buyer, or simply following financial news, understanding these forces helps you make more confident decisions.

If you’re interested in building stronger money habits and learning how markets work in real life, you may also find value in exploring personal finance and business books by Shafaat Ali on Apple Books, which focus on practical skills for income, communication, and long-term growth.

Leave a comment